Founders - Building Your Future with Raiven Capital

by Dr. James Baty, Supreet Manchanda and Paul Dugsin - May 9, 2025

How Founders Can Thrive in the AI Revolution

In the past decade, transformative technologies—AI, IoT, 6G, and data analytics—have evolved from futuristic buzzwords into indispensable tools shaping industries worldwide. We are accelerating toward what many call the Fifth Industrial Revolution (5IR) , where AI & advanced technologies augment human capabilities rather than replacing them— Augmented Humanity.

At Raiven Capital, we specialize in identifying and fostering technological breakthroughs. We invest in visionary founders leveraging these innovations to build platforms that redefine industries and create lasting profitable impact. If you're developing cutting-edge, tech-driven solutions poised to reshape business and society, we want to hear from you .

Raiven Capital’s Edge: Operator Expertise

Unlike many VC firms that simply provide funding, Raiven Capital brings decades of hands-on operational expertise in building and scaling technology companies:

- We have successfully navigated startups through rapid expansions, major pivots, and high value exits.

- We understand global finance, cross-border regulations, and the complexities of launching products across international markets.

- Our extensive network provides access to strategic mentorship, high-value customers, and potential acquirers worldwide.

Raiven Capital doesn’t just invest—we collaborate. We work side by side with founders, helping to turn bold visions into thriving businesses.

Venture Alchemy: Transforming Ideas into Industry Disruptors

Founders bring spark + tenacity + vision. Raiven provides expertise in business strategy, technology, and market. Together, we shepherd startups through:

- Revenue model overhauls during economic downturns.

- Global expansions that unlock new customer bases and distribution channels.

- High-stakes acquisitions and IPOs that create meaningful value for all stakeholders

Founders, if you're reimagining industries through AI and emerging technologies, we do more than write checks—we actively support your journey. If you're bracing for the inevitable pivots that define early-stage companies, our experienced team ensures that strategic shifts are executed with precision while keeping the bigger vision intact. We are partners in building sustainable success

This blog article is a roadmap for engaging with Raiven and positioning your startup for long-term growth in a rapidly evolving landscape

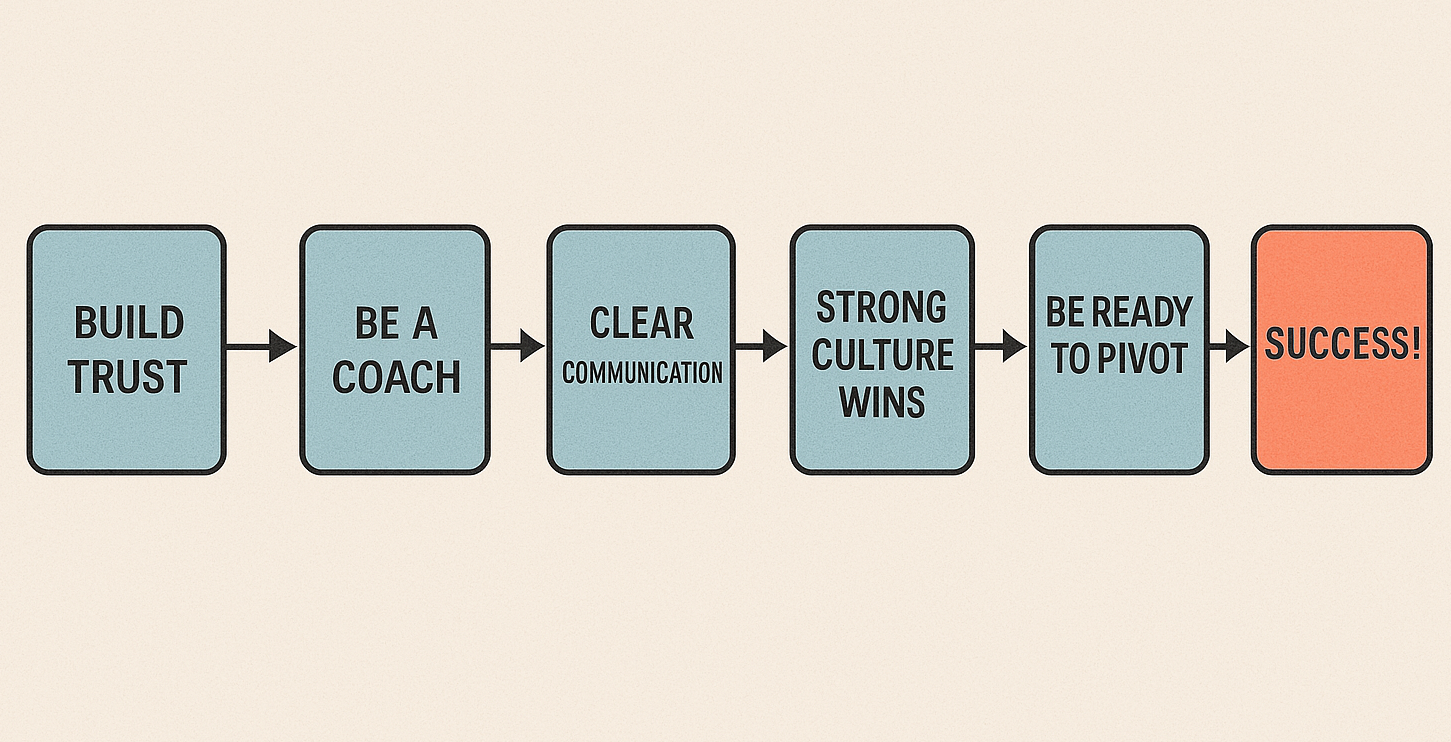

Lessons from Top-Tier VCs: Five Key Strategies for Success

While every VC firm has its own approach, certain foundational principles consistently drive success, as seen in firms like Sequoia Capital, a16z, and Khosla Ventures:

1. Build an Exceptional Team

Recruit “missionaries,” not mercenaries individuals who align with your vision and culture, rather than short-term opportunists. As John Doer, Kleiner Perkins Chair, often counsels, an entrepreneur does more than anyone thinks possible, with less than anyone thinks possible… in whatever field they're working on, they’re the provocateurs, the risk takers, the ‘missionaries’.

2. Be Fearlessly Bold

Transformative ideas target significant market gaps. Incremental improvements gain traction, but 10x solutions create revolutions. a16z’s motto, “Software is eating the world,” suggests that transformative companies come from founders who aim to reshape entire industries.

3. Seek Partners, Not Just Funders

Building a successful startup requires more than capital; it demands strategic guidance, operational expertise, and a network that accelerates growth. As Lightspeed Venture Partners emphasizes, "Depth of relationships means authenticity, transparency and trust."

4. Adopt a Learning Mindset

Seek diverse perspectives, embrace failure as a learning tool, and evolve leadership skills as your company scales. Sequoia Capital’s “ Crucible Moments” stories often highlight how founders who learn fast from mistakes ultimately find success.

5. Think Beyond Fundraising, Focus on Enduring Company Building

Focus on sustainable growth. Investors value capital efficiency, recurring revenue models, and strong customer retention. As Doug Leone of Sequoia Capital counsels, focus on what it takes to build a truly enduring company/

6. MVP = Minimum ‘XXXX’ Product…

Viable, Marketable, Unique… you have to have an ‘mXp’, understand what that means and how they evolve. Speed matters. Launch early, iterate based on real feedback, and refine accordingly… it’s a journey. Check out Iryna Meshchankina’s blog

7. Sell First, Scale Later

Once your product is ready, make sales your top priority. Growth follows revenue, not the other way around. As Mark Cuban constantly coaches… making sales is the surest path to not going broke – Sales Cures All.

While there is an unending stream of advice for founders, following these core principles ensures founders build products that fulfill real needs while preparing for inevitable scaling challenges. Raiven integrates these principles into sharp deliverable results.

The Raiven Five "C"s: What We Look for in Founders

Great ideas and funding alone don’t guarantee success—people do. At Raiven, we assess on the people behind the innovation. Over the years, we have identified five key traits that consistently define successful founding teams—our 5 "C"s:

1. Curiosity

A relentless drive to question, explore, and learn. The best founders uncover hidden opportunities through intellectual agility.

2. Creativity

The ability to craft innovative solutions and challenge conventional thinking. Visionary founders thrive by differentiating from the crowd.

3. Competence

Deep expertise, operational excellence, and a proven ability to execute. Success isn’t about credentials—it’s about delivering results.

4. Chemistry

The intangible but crucial ability to build trust, foster collaboration, and create a strong team culture.

5. Coachability

The capacity to absorb feedback, pivot when necessary, and refine leadership skills continuously. Adaptability often separates thriving ventures from those that falter

When combined, these qualities amplify success, as a force multiplier, fueling resilience and strategic execution in high-growth technology startups. Not everyone has them all… Raiven’s operator experts help recognize and fill in the gaps to fortify culture.

Pivotability: A Defining Factor in Startup Success

Beyond embodying the 5 "C"s and embracing the fast-paced startup landscape, founders must be prepared to adapt. No matter how strong your product or team, market conditions shift. The Startup Genome Project reports that 70% of startups pivot at least once. What does this mean for you?

- Pivoting boosts success rates: Startups that pivot 1-2 times raise 2.5x more capital and are more likely to scale successfully.

- Types of pivots: Companies frequently refine their product, reposition their target audience, adjust pricing models, or shift their go-to-market strategies. Slack and Twitter are prime examples of successful pivots.

- Fail fast, learn faster: As Eric Ries underscores in The Lean Startup, knowing when to pivot is a critical survival skill. Companies that resist necessary change risk running out of resources before finding product-market fit.

Agility and adaptability are non-negotiable. Our operational experience means we help founders recognize when to pivot—and how to execute it strategically.

Be ready to pivot. Timing is everything.

Charting Your Path with Raiven Capital: How It Works

Phase 1: Initial Engagement

- Send Your Deck & Demo.

We evaluate your tech, MVP or proof of concept, prioritizing functionality and user traction. We want to see real product functionality or user traction, even if it’s modest.

- Assessing Fit

During early conversations, we’ll explore how your mission aligns with our 5 ‘C’s framework and technology platform focus (Team + Tech).

Phase 2: Deep Dive

- Due Diligence.

Expect a rigorous analysis of your technology, market potential, and financial structure. Transparency is key to a strong partnership.

- Strategic Roadmapping

Together, we craft a comprehensive go-to-market plan and explore potential pivot strategies.

Phase 3: Partnership & Execution

- Investment Terms.

We aim for a “build to exit” ethos—crafting structures that position you for growth, without losing sight of potential acquisition or IPO pathways.

- Hands-On Collaboration

Post-investment, our operator team works with you to refine your business roadmap, expand your reach, and set milestones that align with larger-scale exit strategies.

Phase 4: Scale and Exit

- IP Strategy & Runway Optimization

Intellectual property is a leverageable asset, not just a safeguard. We help maximize its strategic value.

- Partnerships & Distribution Channels

Strong sales networks and strategic partnerships drive scale. We help forge these connections.

- Global Expansion & Alternative Exit Strategies

We assist in scaling beyond domestic markets, ensuring founders optimize for the best possible exit outcomes.

Fostering a Culture of Enduring Success

Beyond capital and fleeting tech trends, culture is the foundation of enduring success. It serves as the unifying force that brings together all essential elements—product-market fit, transformative vision, and team cohesion. Cultivating a resilient, mission-driven organization requires:

- Hiring for both values and expertise - assembling a team driven by the same vision and long-term aspirations.

- Encouraging cross-functional collaboration - leveraging diverse perspectives to fuel innovation.

- Maintaining financial discipline - ensuring smart runway management so your team remains focused on meaningful product-market progress rather than chasing the next round of funding.

When your culture aligns with Fifth Industrial Revolution (5IR) principles—human-technology synergy, ethical innovation, and scalable, sustainable processes—you create an environment where experimentation flourishes while outcomes remain rooted in market realities.

Let’s Build the Future Together

Technology isn’t just reshaping business—it’s redefining what it means to be human in an age of hyper-connectivity and cognitive automation. The most visionary founders recognize this moment as unique opportunity to elevate entire industries. These are the entrepreneurs Raiven Capital seeks to champion.

- Demonstrate product-market traction, even in its early stages

- Show us how your team embodies the five ‘C’s.

- Stay adaptable—pivot when the market demands it—but remain steadfast in the vision that ignited your venture.

With grit, creativity, and the right strategic guidance, the possibilities are limitless. Our hands-on, partner-driven approach is what sets Raiven Capital apart—delivering value not just to founders, but to investors and society at large.

We can’t wait to see what you’ll build—and how we can help propel you to the next level.

Let’s connect. Share your story. The future won’t wait—let’s shape it together.